Redefining "Margin of Safety"

How the Nature of Growth and Adaptability Informs Investing

A PDF of this paper can be downloaded HERE.

At NZS Capital, we don’t believe it’s possible to accurately predict the future with any meaningful degree of precision. As far as we can tell, no one is very good at it. A few people, most notably economists, are embarrassingly bad at it. The prediction game has such low odds of winning (as it favors blind luck over innate foresight), that we prefer to play a different game.

Ben Graham posited the idea of “margin of safety” in The Intelligent Investor back in 1949. It was so important to him that he devoted the entire final chapter of the book to the concept: Chapter 20 - "Margin of Safety" as the central concept of investment. Graham’s ideas have since been popularized by Buffett and become the cornerstone of value investing. Here’s Graham’s definition:

“The function of margin of safety is, in essence, that of rendering unnecessary an accurate estimate of the future. If the margin is a large one, then it is enough to assume that future earnings will not fall far below those of the past in order for an investor to feel sufficiently protected against the vicissitudes of time.”

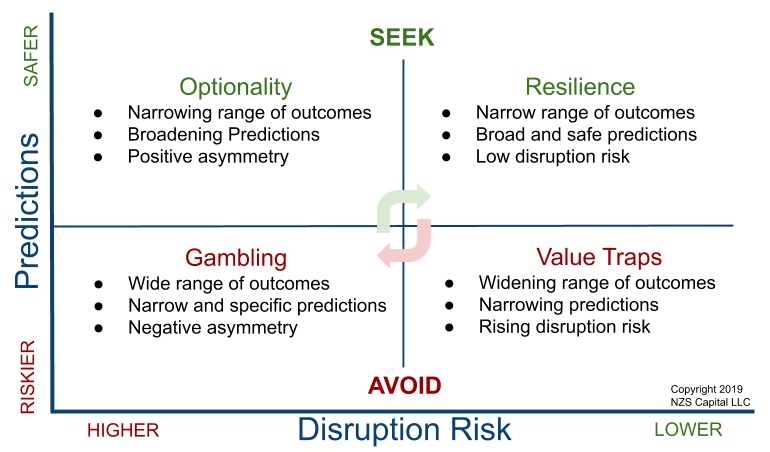

We agree, but approach the question differently. Using value investing as an example: given a stock’s current market valuation, we focus on the type of predictions we have to make for forecasting the company’s future prospects. If the valuation is expensive, then we have to make more narrow (i.e., highly precise) predictions. If the valuation is cheap, then we have a bit more leeway and can make broader (i.e., less precise) predictions about the future. Since we don’t believe it’s possible to predict the future with a high degree of both precision and accuracy, we’re always looking for situations where we can make predictions with the broadest range possible, thus giving us higher odds of being correct – what Graham would call a ‘large margin of safety’.

We don’t expect successful business managers to be fortune tellers either. So what do you do if you can’t predict the future, and don’t want your company caught off-guard as you navigate an uncertain, ever-changing economic landscape? We’ve found that nimble, adaptive companies tend to be successful over the long term and offer investors a wider margin of safety. Indeed, we would argue that relying exclusively on valuation for safety, especially given the accelerating pace of disruption in the Information Age, is downright dangerous. Age-old concepts such as mean reversion and intrinsic value now have become misleading, and using valuation alone to determine margin of safety is akin to the bumper sticker we used to see around Silicon Valley after the dotcom crash: “Please God, Just One More Bubble”. ‘Value traps’ seem to be a symptom of the digital paradigm shift, occurring when Industrial Age companies fail to adapt to the Information Age – hoping the world will cycle back to a bygone era is not a productive business model and an even worse investment strategy.

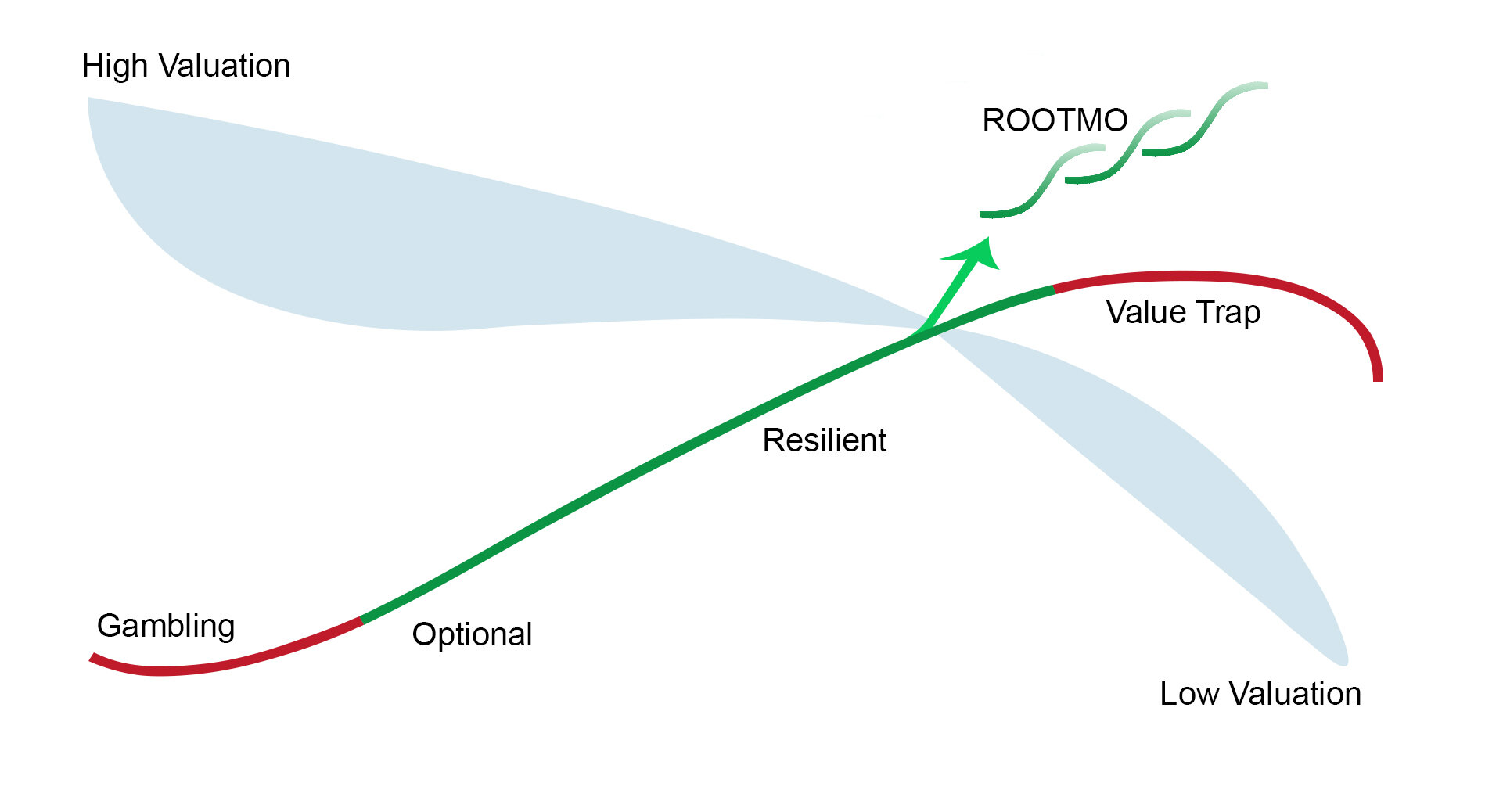

The lifecycle of a company: most new ventures start off as gambles. As the products/services gain in the marketplace, they become Optionality businesses with positive asymmetry. Over time, adaptable companies can build Resilience. However, eventually most companies lose their market position and become classic Value Traps, and may even end up becoming gambles at the end of their lifecycle.

The lifecycle of a company: most new ventures start off as gambles. As the products/services gain in the marketplace, they become Optionality businesses with positive asymmetry. Over time, adaptable companies can build Resilience. However, eventually most companies lose their market position and become classic Value Traps, and may even end up becoming gambles at the end of their lifecycle.

As with predicting the future, picking companies with eroding profits that will have a eureka moment and successfully pull out of their death spiral is a low-probability game we’d rather avoid entirely. Companies that are caught on the wrong side of time tend to focus capital allocation on share buybacks, debt repurchase, or dividends rather than R&D and innovation, hastening their decline.

We’ve previously detailed our investment philosophy, centered around deep analysis of Quality, Growth, and Context (with valuation factoring into Context), in Complexity Investing. Here, we advance the idea that ‘nature of growth’ is a critical factor in determining a company’s ability to adapt, and explain why long-duration, slow-growth companies offer a desirable margin of safety.

Quality Management and Slow Growth Confer High Adaptability

In Complexity Investing, we wrote at some length about the importance of management team Quality for fostering a culture of adaptability. Quality is easy to spot but hard to define. Pirsig, in Zen and the Art of Motorcycle Maintenance, offers the best definition of quality we know of:

“Any philosophical explanation of Quality is going to be both false and true precisely because it is a philosophic explanation. The process of philosophic explanation is an analytic process, a process of breaking something down into subjects and predicates. What I mean (and everybody else means) by the word ‘quality’ cannot be broken down into subjects and predicates. This is not because Quality is so mysterious, but because Quality is so simple, immediate and direct.”

The key factors we identify with Quality management are: long-term thinking, decentralization, and ability to foster a culture of adaptability/innovation. What we’ve come to realize, however, is that Quality management is only part of the story – necessary but not sufficient – because a company's ‘nature of growth’ also factors heavily into adaptability.

Investors often celebrate brilliant managers and criticize those that fail to see future pitfalls. But perhaps investors have put too much emphasis on management teams. It seems likely that success isn’t determined exclusively by the management team per se, but also by the time constraints under which the management team has to adapt, which is governed by the speed of their business.

When we look at classic, gentle sloping ‘S-curve’ businesses, the managers tend to look like geniuses when it comes to adaptability; however, maybe management teams running long-duration, slow-growth businesses are adaptable because they have adequate time to see and react to change. In other words, perhaps brilliant managers don’t necessarily have exceptional foresight and instincts, they just have the luxury of a longer reaction time (or an apparent longer reaction time...more on that idea later).

In this example of a gentle sloping S-Curve, a company has time to adapt and innovate – stacking on new S-Curves to become Resilient with Out-of-the-money Optionality (ROOTMO) – rather than slowly dying as a Value Trap (where most Investors equate “cheap” with “margin of safety”).

In this example of a gentle sloping S-Curve, a company has time to adapt and innovate – stacking on new S-Curves to become Resilient with Out-of-the-money Optionality (ROOTMO) – rather than slowly dying as a Value Trap (where most Investors equate “cheap” with “margin of safety”).

Imagine a driver following a car in front of them at a two-second distance versus a driver tailgating a car. If the car in front stops suddenly, the tailgater is highly likely to crash whereas the two-second follower may avoid the accident. It’s not that the safe follower has any better adaptability genes than the tailgater, they simply have more time to make course corrections before it’s too late. Perhaps that’s the genius of management teams that are seen as brilliant adapters: slower growth, dictated (intentionally or unintentionally) by their business model, gives them WAY more time to react. Of course, nowadays, many cars have integrated collision-avoidance technology, which provides hazard data to the car far more quickly than can the human driver. In the same manner, Quality data can serve as an advanced warning system for economically-relevant changes ahead, thereby expanding a company’s reaction-time window.

Faster-growth businesses with shorter product cycles generally don’t offer managers any advanced warning of change and allow only a narrow window for adaptation. These managers often end up as the ‘One Hit Wonders’ of the corporate world: they lead businesses to explosive growth only to be blindsided by sudden change. Groupon, Zynga, PortalPlayer, Synaptics, GoPro, FitBit – history is littered with these victims of disruption.

This challenge of adaptation faced by fast-paced businesses brings a Buffettism to mind: “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it’s the reputation of the business that remains intact.” We might adapt this saying to something like: When a Quality manager with a long-term track record of adaptability takes the helm of a fast-changing, steep-S-curve business, they may not emerge with their reputation intact. No traditionally-defined margin of safety would have been enough to protect investors from the downfall of these seemingly promising companies; however, by considering the window for adaptability, it becomes clear that businesses exhibiting rapid growth are much more likely to be shooting stars rather than sure bets.

Characteristics of Slow-Growth, Long Duration Businesses: Governors, Necessity, and NZS

In addition to conferring improved conditions for adaptability, slow growth has the benefit of elongating the duration of growth, with time acting as a magnifier through the magic of compounding. Long-duration, slow-growth companies tend to have a governor, or negative feedback loop, that tamps down the magnitude of their short-term growth. Given a sufficient TAM (total available market), this rate limitation means that a company can expect positive returns for a very long time.

For example, a software company might offer a new process (e.g., virtual simulation instead of physical prototyping) that radically changes the nature of R&D at a product company. Upgrading to the virtual simulation would allow for a quicker design process with more iterations. However, in order to implement this process, the entire R&D department would have to be restructured around the new software platform, a high hurdle that most companies would be slow to tackle. Over the long term (barring disruption), every company in that industry would have to eventually modernize to stay relevant. As a result, the software company is unlikely to experience explosive growth in any one year but could post reasonable growth over decades.

A common thread with most long-duration, slow-growth companies is that they have become so ‘mission critical’ to their customers that tight integration develops between producer and consumer. R&D becomes a collaborative effort with prototypes, refinements, and tailor-made products. As a result, the producer has so much (essentially real-time) aggregate data on customer requirements, complaints, and challenges, that they are able to anticipate what the next-generation products should be, layering on new capabilities often before individual customers even fully understand their own needs. This data-driven foresight virtually eliminates guesswork on the part of the producer, dramatically reducing the chances of being blindsided by shifting customer demands. In this type of environment, adaptation becomes second nature.

Now, contrast that scenario with steep S-curve growth. Mercurial customer demands and new disruptions come fast and hard, often because companies don’t have access to meaningful, predictive data. To adapt, management teams may have to upend their entire business model. They might only have one shot to get it right – and within a relatively short time frame as well. If the company survives one round, the nature of their business leaves open the possibility they’ll have to do the same thing over and over again. Successful adaptation in this type of environment goes way beyond manager skill and skews heavily toward luck.

Another hallmark of a long-duration, slow-growth company revolves around something we call NZS or non-zero sum. We look for companies that are delivering more value to their constituents (customers, employees, society at large, the environment, etc.) than they do for themselves – the essence of NZS. We explored the topic of NZS and its beneficial effects on businesses in a previous white paper: NZS - Non-Zero Outcomes in the Information Age. Briefly, in the world today, the increasing transparency and velocity of information make it challenging for companies to extract high margins from their customers/constituents. While traditional investors may seek businesses with ‘high barriers’ and ‘wide moats’, these can rapidly become vulnerabilities exploitable by a higher-NZS competitor (who, by definition, will be more attractive to customers). In contrast, companies focusing on maximizing NZS become invaluable to their customers and less vulnerable to disruption. These types of companies overwhelmingly exhibit long-term thinking, as shorter-term sacrifices are often required (which effectively act as negative-feedback loops, slowing and elongating growth).

Time Dilation: Slowing Down The Game Clock

Ultimately, what highly nimble companies are able to do is act in a way that slows down time relative to their competitors. The world is moving and changing at an accelerating pace, but with a Quality company operating in a long-duration, slow-growth industry dynamic, it’s possible to operate in a bubble in which time appears to move more slowly than in the frantic world around you. Imagine two paths connecting two points in time, 2020 and 2021: one short path, where time is normal, and one long path, where time is stretched and slowed. Because time moves slower on the longer, time-dilated path, you have more time to react and adapt relative to your competition on the direct route, so when you both arrive at 2021, you have out-thought and out-innovated your competition.

In physics, Einstein discovered two ways to think about time dilation. The first way is described by Special Relativity: as objects move at higher speeds, their “clocks” will appear to run slower to outside observers. Second, in General Relativity, your “clock” will run slower as you approach large masses (black holes being an extreme example). In fact, since your feet are closer to Earth than your head, they are actually younger than your brain, which is less affected by our planet’s gravity. Luckily, the effects are negligible at these scales!

If you are a competitor at a poorly run company looking across space and time at a high-Quality business, you will be running around putting out fires and focusing on the wrong things while the Quality business will be calm and functional, buying themselves time to focus on their customers, products, etc. When your clock runs slowly, you have far more time to react to change and disruption. Quality is a way to slow down time; it’s like a black hole that allows you to focus on the long term.

Access to data concerning customer needs and future disruptions is another way to effect time dilation, expanding the reaction time window and facilitating early adaptation.

Likewise, innovation also slows down time. Think of data/innovation in terms of Special Relativity – if you can anticipate customer needs and innovate more efficiently, that’s like a moving clock; it buys you time relative to the fast moving clocks of your competition, essentially like time traveling to the future!

Tesla is a good example of how to think about time dilation. The company has out-innovated every automaker, which has bought them at least a five-year headstart – the watch is ticking away quickly for legacy car manufacturers wasting their time on combustion engines and failing to develop the electric drivetrain, batteries, software, data, and sensors they need to build a modern car. But, at Tesla, they’ve enacted a paradox: by quickly innovating around the needs of their customers, they’ve slowed down time and pulled years ahead of the competition. If Tesla continues to gain market share, they will be like a gravity well, or a back hole, allowing them to operate far into the future ahead of their competition.

Amazon is another great example – for years, the company innovated to stay ahead of the competition in retail and cloud computing, buying themselves time along their way. And now they have created such large, defensible gravity wells of network effects around logistics and technology that they exist years ahead of their competition.

We’d be remiss if we didn’t extend our physics metaphor by talking about time’s arrow itself: entropy. Entropy is a measure of disorder: around the start of the Universe (at least the part that’s visible to us) ~14B years ago, matter and energy were very organized – i.e., there existed an extremely low entropy state. When you have information (a.k.a. order) entropy is very low. As information (or matter and energy) become disordered, entropy grows over time.

Life, as it turns out, is uniquely suited to taking ordered, high-information matter/energy and turning it into disordered, low-information states; indeed, this seems to be the vector of the Universe and life’s role in it. For example, take sunlight, plants, and animals: sunlight is highly-ordered electromagnetic rays that help plants grow through photosynthesis; then animals eat those plants (and sometimes animals eat the animals that eat those plants); and then animals (e.g., humans), turn that energy into all sorts of interesting things, ultimately scattering that neat, organized solar energy into myriad disorder around the planet and surrounding space.

Much of what society has done is to try to create temporary order despite the long-arching trend toward disorder in the Universe. We build buildings, cities, communities and companies – we take organized energy and reshape it into all sorts of literal and figurative structures. But, it’s only a temporary, local increase in order, and, in the long run, the information value is lost and entropy rises. The trend toward more disorder means that predicting the future is very hard, if not impossible; therefore, companies that can slow down time don’t need to operate with rigid views of the future. Thus, they are more adaptable and durable.

Conclusion: Beyond valuation. Slow-Growth, Long-Duration Companies with Adaptable Management Maximize Margin of Safety

Graham offered a helpful lens by introducing ’margin of safety’ as the central concept of investment. At its core, the concept is about investors’ inability to predict the future. We agree that humans are terrible at accurately and narrowly predicting the future, but question the over-emphasis on valuation. We posit that value-based margin of safety is all too often used to justify ownership of dying businesses. While cheap, these value traps do not control their own destiny, devoting resources to life support and/or blind attempts at reinvention; and, all too often, it’s too late. Instead, the ability of a company to adapt – which, in turn, is dependent upon management Quality and nature of growth – is critical to any formulation of margin of safety. Hallmarks of gentle sloping ‘S-curve’ businesses that we look for are negative feedback loops, tight-knit customer relations, and positive NZS. Slow, long-duration growth allows for timely innovation, decelerating the game clock so managers can make smart decisions and maintain their lead through adaptation.

Click HERE to SIGN UP for SITALWeek’s Sunday EMAIL (please note some ad blocking software may disrupt the signup form; if you have any issues or questions please email sitalweek@nzscapital.com)

Disclaimers:

The content of this newsletter is my personal opinion as of the date published and are subject to change without notice and may not reflect the opinion of NZS Capital, LLC (“NZS”). This newsletter is simply an informal gathering of topics I’ve recently read and thought about. It generally covers topics related to the digitization of the global economy, technology and innovation, macro and geopolitics, as well as scientific progress, especially in the fields of cosmology and the brain. I will frequently state things in the newsletter that contradict my own views in order to be provocative. I often I try to make jokes, and they aren’t very funny – sorry.

I may include links to third-party websites as a convenience, and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by NZS Capital, LLC (“NZS”). If you choose to visit the linked sites, you do so at your own risk, and you will be subject to such sites' terms of use and privacy policies, over which NZS Capital has no control. In no event will NZS be responsible for any information or content within the linked sites or your use of the linked sites.

Nothing in this newsletter should be construed as investment advice. The information contained herein is only as current as of the date indicated and may be superseded by subsequent market events or for other reasons. There is no guarantee that the information supplied is accurate, complete, or timely. Past performance is not a guarantee of future results.

Investing involves risk, including the possible loss of principal and fluctuation of value. Nothing contained in this newsletter is an offer to sell or solicit any investment services or securities. Initial Public Offerings (IPOs) are highly speculative investments and may be subject to lower liquidity and greater volatility. Special risks associated with IPOs include limited operating history, unseasoned trading, high turnover and non-repeatable performance.