NZS Capital Third Quarter 2020 Update

October 14th, 2020

The NZS Capital Global Growth Strategy returned 14.71% (14.52% net) in the third quarter of 2020 and 32.50% (31.83% net) year to date compared to the Morningstar Global Markets GR Index returns of 7.95% and .94% for the same periods. The NZS Capital Global Select strategy returned 19.10% (18.9% net) in the third quarter of 2020 and 36.88% (36.19% net) year to date.

For A Table of Performance Please Download the Letter PDF

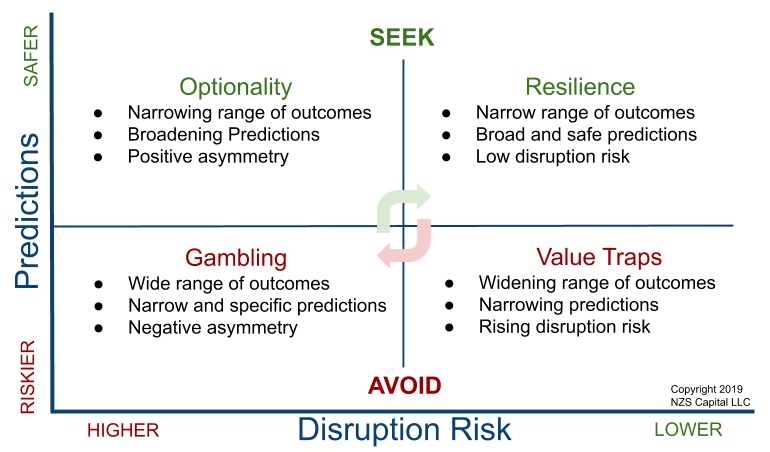

The third quarter was marked by ongoing uncertainty and volatility due to the pandemic and geopolitical events. The research process at NZS Capital is guided by the unpredictability of the world around us. Our lens on the world, which does not rely on narrow predictions of the future, is ideally suited to the current state of the markets. We believe companies that maximize non-zero-sum outcomes for all of their constituents, including employees, customers, suppliers, society, and the environment, will also maximize long-term outcomes for investors. Our view of the world informs our portfolio construction process, which combines a relatively small number of Resilient companies with a long tail of Optionality companies. Resilient businesses have very few predictions and a narrow range of outcomes, while Optionality businesses have a wider range of outcomes and their success hinges upon a more specific view of the future playing out. This combination of long-duration growth with asymmetric upside is well suited to navigating the increasing pace of change throughout the global economy.

The following year-to-date performance discussion references the NZS Global Growth strategy, which represents our broadest approach in terms of number of names and sectors. Technology remained our largest weighting year to date at 62.58%. Our technology investments were up 34.82% compared to the technology component of the benchmark which rose 29.03% year to date. Other significant contributors to performance in the period were our stock selection in consumer discretionary and real estate (REITs) along with our underweights in energy and financials. In the third quarter our top contributors were Nvidia, Sailpoint, Taiwan Semiconductor Manufacturing, Salesforce.com, and Tesla. Detractors from performance included Micron, Microchip, American Tower, Guidewire, and Thor Industries.

Commentary

The following is adapted from our weekly newsletter #259:

At NZS Capital, we are always reminding ourselves that no one can predict the future, even with perfect information. That notion can feel uncomfortable, and even a bit paralyzing. We do, however, know that there are certain elements of a company’s culture and products that afford better odds of future success. Chief among those are a company’s adaptability and the level of NZS, or non-zero sum, they provide – the more value they create for others, the more value they will ultimately create for themselves down the road. One way to frame a hypothesis regarding a future outcome, without having to rely too much on a crystal ball, is like this: “In five to ten years I think blank will happen, but I don’t know how it will happen, what it will look like, or who will win.” Example: In five to ten years, people will watch more video content, but I don’t know what types of devices it will be on (screens or AR/VR glasses?), what type of content it will be (scripted Hollywood, interactive life streaming, immersive metaverse gaming, casual games, etc.), or who will be making more of the content.

We can separate these statements into broad predictions, which are more likely to happen in various futures, and narrow predictions, which are difficult to know ahead of time. Some of the broad predictions would be: 1) semiconductors and connectivity will be in more demand; 2) creativity and storytelling will always be important; 3) data – and smart use of it – will be important; 4) if interactive content rises, gaming engines will be more important in creation of content; 5) cloud computing and AI will be important; 6) people’s tastes will always be fickle and personal, and thus hard to predict. These broad predictions create a landscape in which to plant various narrow predictions and monitor growth and outcomes. Many factors will determine which predictions grow stronger and which wither and die, including, first and foremost, adaptability and NZS, but also network effects, innovation, platform dynamics, etc. If we were to look today at, for example, what content is the most adaptable and highest NZS for consumers, it’s probably video games and life sharing/streaming via social networks or YouTube. These forms of content can change their storytelling easily, provide the largest amount of content per dollar spent, and generally create win-win for all constituents. Some views will be Resilient – fairly broad and safe predictions (e.g., semiconductors will do well), and some will be Optional – narrow predictions (e.g., specific content/video game will gain share). This process is at the heart of our investing strategy and is detailed in our paper, Complexity Investing, which provides a framework for identifying winning companies and constructing a portfolio that balances Resilience and Optionality.

As you objectively assess new information, you can water and prune this landscape of broad and narrow predictions. It’s important not to let the narrow predictions become giant weeds. Letting your narrow prediction winners run is a false narrative that feeds off a set of cognitive biases (bias traps are also addressed in our Complexity Investing paper). At NZS, we tend to let our Optionality (narrow prediction) positions grow in the portfolio only if the range of outcomes is becoming more narrow – meaning that the prediction itself is becoming more broad (see figure at the end of this letter). If the range of outcomes has remained the same, but a company’s market value is up, then letting the position grow in the portfolio is akin to doubling down at every spin of the roulette wheel without taking any chips off the table (an obvious and risky mistake given the very narrow chance of future payout). Further, when you prune an Optionality position, you use the excess to seed new Optionality positions and/or water the ones that are experiencing a narrowing range of outcomes. This strategy allows you to maintain the overall asymmetry of the portfolio while not concentrating risk. If you let a winner run even though the range of outcomes is still very wide, then you are explicitly making a large bet on a narrow prediction about the future, which means all you have done is increase the risk in the portfolio. And, in turn, you are starving resources for new Optionality positions. Complex adaptive systems teach us that very narrow predictions are overwhelmingly likely to be wrong. Some Optionality positions end up being giant, adaptable oaks that last decades; however, the majority – including most/all of your cherished favorites – end up as weeds.

Thank you for your continued trust, interest, and support.

Optionality positions, which have a wide range of outcomes, should only graduate to larger positions if that range is narrowing, and the predictions are becoming safer. For more see Redefining Margin of Safety.

There is no guarantee that the information presented is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Net returns are calculated by subtracting the highest applicable management fee (1.00% annually, or .0833% monthly) from the gross return. The management fee includes all charges for trading costs, portfolio management, custody and other administrative fees. Actual fees may vary depending on, among other things, the applicable fee schedule and portfolio size. The fees are available on request and may be found in Form ADV Part 2A. Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

Any projections, market outlooks, or estimates in this presentation are forward-looking statements and are based upon certain assumptions. No forecasts can be guaranteed. Other events that were not taken into account may occur and may significantly affect the returns or performance. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur.

Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to change at any time due to changes in market or economic conditions. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use.

An investor should not construe the contents of this newsletter as legal, tax, investment, or other advice.

Morningstar Global Target Market Exposure NR USD is a rules based, float market capitalization-weighted index designed to cover 85% of the equity float-adjusted market capitalization of the Global equity markets.

Morningstar Developed Markets Technology NR USD measures the performance of companies engaged in the design, development, and support of computer operating systems and applications. This sector also includes companies that provide computer technology consulting services.

NZS strategies are not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to the owners who invest in the strategy or any member of the public regarding the advisability of investing in the strategy y or to any member of the public regarding the advisability of investing in equity securities generally or in the strategy in particular, or the ability of the strategy to track the Morningstar Global Target Market Exposure Index or the Morningstar Developed Markets Technology Index or the equity markets in general. THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE STRATEGIES OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN