Welcome to Stuff I Thought About Last Week, a collection of topics on tech, innovation, science, the digital economic transition, the finance industry, cannonballs, and whatever else made me think last week. Please grab me on Twitter with any thoughts or feedback.

Click HERE to SIGN UP for SITALWeek’s Sunday EMAIL (please note some ad blocking software may disrupt the signup form; if you have any issues or questions please email sitalweek@nzscapital.com)

In today’s post: Facebook enters the operating system battle as tech co-opetition rises; a new cannonball run record has been set; iBuying is surging along with demand for new single family homes in the US; use of technology in schools is proving problematic; AI should have a will to live; don’t sweat the blue light; delayed IPOs contributing to inequality; and lots more below…

Stuff about Innovation and Technology

Cannonball Run!

A team of sophisticated speedsters broke the record for a nonstop drive from NY to LA – averaging 103 mph (including pit stops) over 27 hours and 25 minutes. The trio drove a high-tech, custom-outfitted Mercedes and used scouts along the way to evade police and complete the drive as safely as possible (probably safer than texting while driving!). The article describing the new cannonball record is sure to quicken your pulse.

Uber Air and Building a Better Battery

Uber is partnering with Joby Aviation for an electric air taxi service targeted for launch in 2023. Few details are available about the Joby craft, which is described as a hybrid drone/plane that can travel at twice the speed of a helicopter. Maybe the flying craft can get a boost from the new battery technology unveiled by IBM this week – higher power density, faster charging, and safer compared to Lithium Ion...and they are made from minerals extracted from ocean water. These yet-to-be-commercialized batteries don't need any heavy metals like cobalt, which is a good thing, as International Rights Advocates are suing Apple, Google, Microsoft, Tesla, and Dell over child deaths in the Democratic Republic of Congo related to cobalt mining – the suit claims the tech giants are not implementing their existing policies to protect children in their quest for EV-battery raw materials.

AlGaAs and AlGaInP

Scientists at NREL have figured out how to combine aluminum with lower-cost gallium arsenide (AlGaAs) and gallium indium phosphide (AlGaInP) in hydride vapor phase epitaxy (HVPE) reactors to create solar panels. If commercialized, it would bring improved efficiency (perhaps up to 29%) at lower costs. A lot of solar “breakthroughs” should be met with skepticism, but this one appears to be a legitimate advance.

Google Recreates Voices for People Who Can’t Speak

Google and Deepmind used audio from old footage of NFL linebacker Tim Shaw to create a new AI speaking engine for the ALS-afflicted man. Using Wavenet, which mimics intonation and emphasis, combined with Google’s specialized TPU chips, the system can create one second of speech in just 50 milliseconds. The tech is set to debut in a new YouTube miniseries hosted by Robert Downey Jr. titled “The Age of AI.”

The StarCraft of Shopify

Ever wonder how Shopify is like the game StarCraft? Well, I never did either. But, this fascinating example of non-obvious dot connecting in the Non-Gaap Thoughts newsletter does just that. If you’re interested in understanding Shopify’s business, the CEO of Shopify himself responded to the creative post by saying “that's a frighteningly good read of my psyche.” Mike provides the following description, which appears to have interesting similarities with adaptability and evolutionary fitness functions: "StarCraft is like a constantly evolving game of chess with incomplete information about the opponent’s layout, pieces, and attack/defense strategies. You must continually “read and adjust” your go-to-battle strategy as you learn more about your opponent’s positioning, buildings, and army composition. It’s an iterative loop."

Facebook's New OS

The Information reports that Facebook is building a new standalone operating system to rival Android as the company makes a more concerted effort to gain share of the hardware market for AR, VR, etc. There are a lot of themes in the article that are squarely aligned with a recurring topic at SITALWeek: vertical integration of semiconductors, operating systems, and hardware is creating new customers and spurring device proliferation, thus supporting long-term growth for the chip industry (FB apparently even mulled acquiring Cirrus Logic, a maker of audio chips for Apple and others, for more than it paid for Oculus). There is no particular reason why FB’s dominance in social networking implies an advantage in hardware, operating systems, or chip design. The key driver of vertical integration and increasing returns to scale in new consumer technologies is extensive access to data, which creates AI advantages. Social data are interesting, but their utility pales in comparison to the mega datasets at Amazon and Google. (Meanwhile, Apple remains the most disadvantaged with their anti-data stance).

Tech Giants are Playing Nice

While there are a lot of reasons to be concerned about lack of competition amongst the tech giants, there are pockets of very healthy sparring – including cloud computing, AI, voice, hardware, and, now, operating systems with Facebook’s efforts. However, over the last 18 months, Amazon, Google, and Apple all started to play more nicely with each other, which may be the beginning of a consumer technology and services leaders’ bloc – to the detriment of other emerging competitors. Examples include: Apple TV+ on Amazon Fire, Apple Music on Alexa devices, Prime Video on Chromecasts (covered briefly in SITALWeek #201), YouTube returning to Fire devices, etc. Another example would be Microsoft and Sony joining forces on cloud gaming (SITALWeek #193/#194).

And, this week we saw an interesting, key example of co-opetition between Apple, Amazon, and Google as they join with Zigbee to make smart home devices interoperable. In this instance, the tech giants are joining other smart home device makers, like Samsung, who are already members of the Zigbee alliance, which is an important step toward open competition in the home. To wrap this section on tech platform competition trends: in isolation, these developments don't seem like a lot, but in aggregate, there is a clear tension between competition and cooperation today that, depending on which way the pendulum swings, could lead to non-optimal outcomes if data access remains monopolized at the tech giants.

Schools' use of Tech is at the Bottom of Learning Curve

We recently boycotted our school’s “turn off technology week” primarily because we think teaching a fear of technology likely leads to a worse outcome than teaching how to thoughtfully balance time spent with technology. The school’s reward for skipping screens for a week was ice cream, which is ironic given that the only negative impact that has ever been tied to children's screen use is a moderate risk for obesity! That said, this article in MIT Tech Review suggests there is a good reason to turn off technology in the classroom itself – at least until device providers figure out how to sync up tech and student learning needs: “A study of millions of high school students in the 36 member countries of the Organisation for Economic Co-operation and Development (OECD) found that those who used computers heavily at school ‘do a lot worse in most learning outcomes, even after accounting for social background and student demographics.’...‘Even more troubling, there’s evidence that vulnerable students are spending more time on digital devices than their more privileged counterparts’.”

Amazon vs. FedEx

FedEx whiffed on earnings and outlook this week, and, at this point, I’m starting to feel bad for them, so I won’t dwell on their stock underperforming the S&P 500 by 1800 bps since I first discussed their existential problems in SITALWeek #196 (sorry, it was too hard to resist). But, Amazon has been on a PR blitz for its shipping and logistics lately: delivering half of their 7B orders themselves this year (3.5B packages); dunking on FedEx for missing deliveries by banning Prime sellers from using the struggling shipper; touting the 100,000 jobs created in its last-mile delivery franchises; featuring SVP Operations head Dave Clark in the media – like this Bloomberg puff piece (did Bezos endorse Bloomberg for president in return for good coverage? 😂); and highlighting further the Prime delivery franchising on CNBC. The CEO of FedEx called Clark a smartass in the WSJ a little while back, and maybe he’s right – the Amazon ops head was seen throwing emoji “shade” toward rival Shopify on his Twitter feed.

Breaking News: AWS Using Open Source!

Balancing out the upbeat reporting above on Amazon was the NYT, which reported Amazon is “strip-mining” software startups – copying the products and hiring the engineers. This is quite an amusing attempt by the paper, which contains ALL the news that’s fit to print mind you, failing to understand open-source software. Much of what the NYT cites is just the software pot calling the Amazon kettle black. Open source has been driving software for decades, and AWS’ use of it isn’t anything new. We are probably, ballpark, 10% of the way into the $1.5-2T+ of spending shifting to the cloud, and cloud services are likely to be a case where the best products win rather than one in which enterprises decide to lock themselves into proprietary stacks of tools at Amazon, Microsoft, or Google. Amazon is actually increasing competition by using open source, not hurting it. The size of the market will be so large that this is going to be an “and” not “or” situation: Amazon, Google, and Microsoft will have their tools AND competitors will find ways to add value in a multi-cloud world. I’m still laughing about the bit in the story describing seven open-source-software CEOs gathering for dinner at a Silicon Valley VC’s house to decide if they should accuse Amazon of monopoly behavior for using open-source software – the same free code, written largely for free by developers, that their own businesses are built off of! I can imagine the whining: “I think I should be the only one who can make money from free code other people wrote!” Silicon Valley and the Sulzbergers – always keeping it real for our amusement. For what it’s worth, I believe if an open-source-based software company is adding value and providing a good multi-cloud solution, they have little to fear from Amazon using the same open-source project.

Walmart Super-Data-Center

Walmart wants to turn supercenters into edge computing nodes for autonomous cars and other businesses. I generally think Walmart is playing the long game correctly in ecommerce, and I don’t fault many of their failed experiments along the way; however, this foray into the data-center business is way off base. Data centers need large quantities of power, cooling, and interconnects from every telecom provider – they are unique assets in many ways. If Walmart thought owning IT infrastructure was necessary (and I don’t see the logic at all), they would be better off buying an existing data center company or partnering. Playing to their strengths in grocery and providing a broader, Prime-like bundle would be a much better focus for the company. Walmart “Prime” that included Disney+, Spotify, and Lyft rides would be an enticing value proposition for their customers.

iBuying Tipping Point in Near Future

iBuyers have hit over 10% of transactions in some neighborhoods according to Redfin. What happens when iBuying crosses 50% in certain neighborhoods or zip codes? It’s likely to be a completely game-changing tipping point that will turn buying and selling homes into a highly liquid transaction.

Establishment Preventing Banking Revolution

Earnin is a digital payday lending service that asks users to “tip” money out of their paycheck advances instead of paying interest. Earnin has constant access to your checking account transactions and can adjust how much they will loan you at any given time. Earnin is part of a class of new, ‘friendlier’ payday-advance companies that won’t impact your credit or employ predatory tactics. However, this Atlantic article points out that friendlier doesn’t necessarily imply better for borrowers: “In states where payday loans are allowed, lenders are still required to disclose APR and limit borrowing amounts to a certain percentage of a user’s income. Earnin isn’t. (If it did, would-be borrowers might be alarmed: $9 on a $100 loan over two weeks is over 400 percent; states like New York and Nevada cap the interest rates on loans at 25 percent.)” In a similar vein, this article discusses how fintech lenders like LendingClub increasingly look and act like traditional lenders. There are a host of companies that seem to be trying to build a better, information-based banking/lending system, but a true revolution remains thwarted for now by the establishment of big banks, lobbyists, and regulatory capture.

30-Something Sneaker Wave in Single-Family Housing Stats

Speaking of houses, new, single-family housing starts surprised the market this week by hitting a 12.5-year high. In case you missed it, last week I discussed the reasons behind this trend and why it will continue for around another half decade: The 30-Something Sneaker Wave. Interestingly, this wave of births began in 1989 – the same year that America’s opinion on legalization of marijuana began turning positive, according to "19 interesting things from 2019" over at Pew Research...coincidence? Also in that Pew report: “A single person watching YouTube videos for eight hours a day with no breaks or days off would need more than 16 years to watch all the content posted by just the most popular channels [>250k subscribers] on the platform during a single week.”

Miscellaneous Stuff

Damasio’s New Laws of Robotics: Feel Good and Empathize

Antonio Damasio argues that we should give AI a will to live. The basic idea is to give robots the same drive toward homeostasis that humans have – regulating their condition inside of a narrow range for survival. Damasio and his collaborator have shown that humans’ higher-level cognition likely came from a desire to maintain homeostasis. The neuroscientists suggest two new rules to replace Asimov’s three laws of robotics: 1) feel good and 2) feel empathy. Damasio is the author of one of my all-time favorite books, Descartes’ Error, which explains just how wrong it is to believe “I think, therefore I am.”

Blue is the New Red

Back in SITALWeek #196, I talked about how using dark mode on mobile devices might be worse for us due to how the brain is geared toward interpreting dark-on-light as opposed to light-on-dark backgrounds. Now, new research (in a mouse model) suggests that blue light isn’t the problem, but overall exposure and brightness probably is. Dusk is actually a period of bluer light, and in mouse studies, those hues are more relaxing than the warm amber tilt most night modes display.

Frivolous 5G Fears

I know that SITALWeek readers are too well informed to fall for the tinfoil-hat brigade’s 5G fear mongering, but in case you need a story to share with your Crazy Uncle during holiday festivities, Wired magazine covered the safety of non-ionizing electromagnetic waves last week. I’ve addressed these concerns before, and if you’re scared of 5G, you’d do well to adopt the vampire lifestyle, because you should be absolutely terrified of sunlight.

Words of Wisdom from Brent Beshore

Brent Beshore had a tweet this week bringing new insight to honesty and kindness. Following up on some wise words from Annie Duke he said: “...kindness and niceness often conflict. Love manifests as truth + grace + patience. Without truth it's niceness. Without grace it's judgmentalism. Without patience it's abrasion.” Someone else I know says “don’t just tell me I’m wrong tell me I’m really f#$@ing wrong, and here’s why” because that’s the kind thing to do. Brent’s latest annual letter on adventur.es' year in middle-market PE is also a very worthwhile read.

One Year of SITALWeek Derived from 6M+ Words

Ever wonder how much reading goes into producing SITALWeek? Around half of what I read I store in the Pocket app (which I highly recommend) while the other half I don’t find interesting enough to save. A fraction of what I save in Pocket, along with books and podcasts, feeds into SITALWeek. So far, I’ve been in the top 1% of users since Pocket came to be; this year, I’ve read 43 books worth of articles, or 3.2M words, which means I discarded a similar amount as well. That’s a lot of words!

Stuff about Geopolitics, Economics, and the Finance Industry

Money + Morality = Social Change

GS wrote in this FT op-ed that it will target $750B “in ‘financing, investing and advisory activity’ over the next decade related to climate change and ‘inclusive growth’.” As a species, we’ve always risen to overcome challenges and survive, and that’s especially true when there is overlap between win-win outcomes and making money – there’s good reason to be optimistic about climate change and human ingenuity.

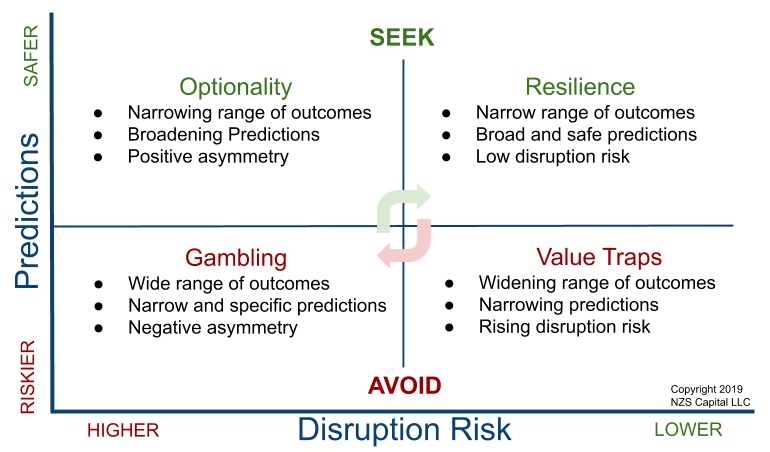

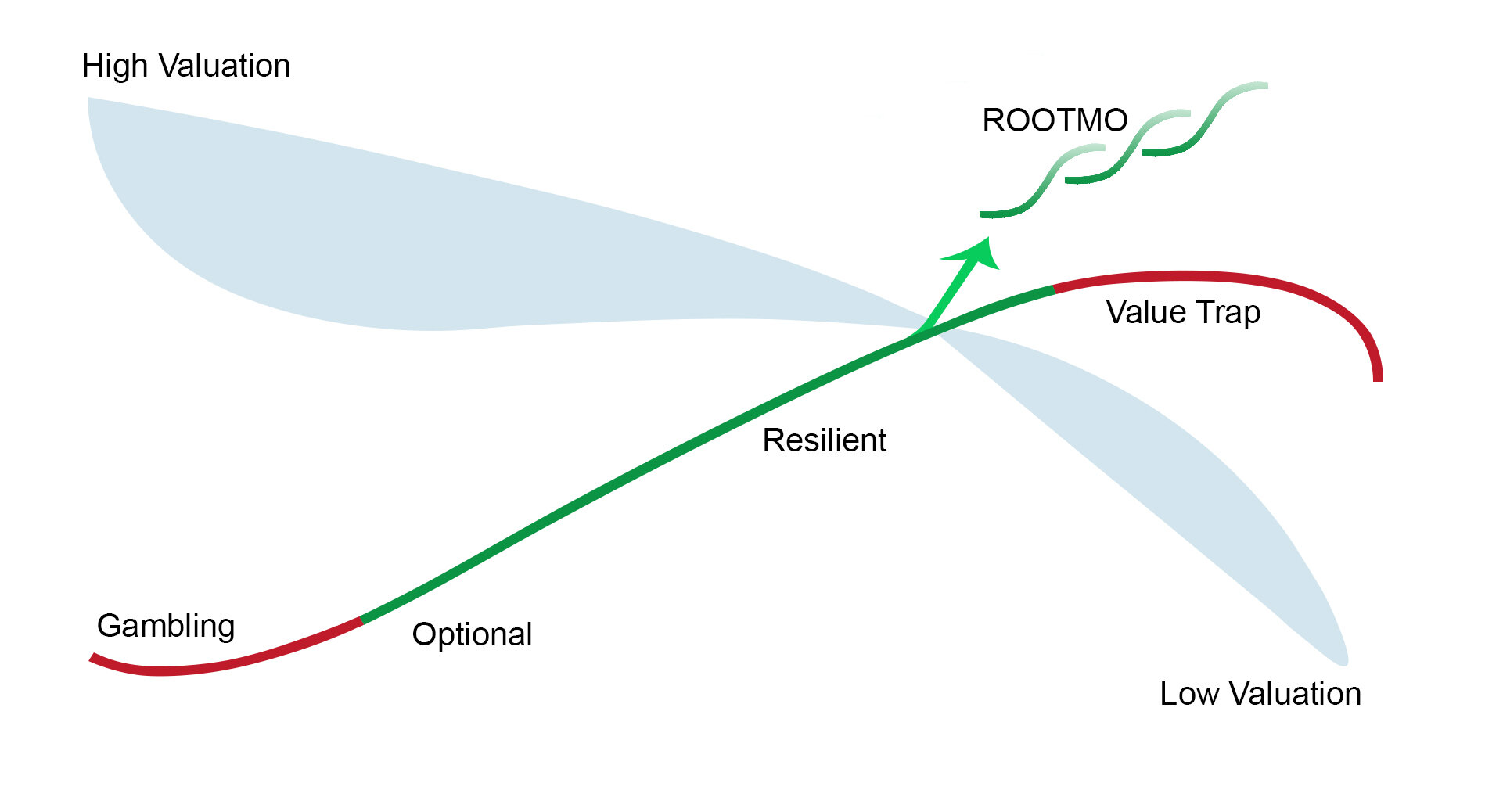

Moral Hazard with Private Capital-Delayed IPOs?

There aren’t enough people investing enough savings in the stock market, often because they don’t have the budget to do so, and that’s a society-wide problem. Yet, the stock market remains the best way for average investors to access the compounding returns from long-term growth investing. When companies that could go public instead stay private longer, returns can accrue in greater proportion to elite investors – general and limited partners and institutions that meet the accredited investor hurdle (in the US that’s currently $1M in net assets excluding primary residence, or ongoing $200k+ in annual income, according to the SEC). In some cases, these investors are pensions or endowments, who distribute returns more broadly; however, many profits from private investing seem to end up concentrated at the top (if you have data on this please send it my way, I am acting on instinct here). Therefore, companies who can and should go public – but choose not to – are perhaps contributing to the rise in inequality. Sometimes, the delay is warranted because companies need more time, e.g., to crystallize their path to profit; but often times, it’s simply a combination of fear, ego, or misunderstanding of how public markets work. Back in 2015, I penned this essay In Defense of Being a Public Company, and, although I fully admit NZS Capital benefits from having more great growth companies in the public markets to invest in, I think most companies are making a mistake staying private too long. Going public will up your game, lower your cost of capital, provide greater Optionality and flexibility, improve recruiting, and much more. I expect the current SEC review of direct listing changes proposed by the NYSE will likely defer even more IPOs, as companies wait to see what their options are, which would be a disappointing missed opportunity for average investors looking to grow capital for their future and retirement.

⛄✌

Disclaimers:

The content of this newsletter is my personal opinion as of the date published and are subject to change without notice and may not reflect the opinion of NZS Capital, LLC (“NZS”). This newsletter is simply an informal gathering of topics I’ve recently read and thought about. It generally covers topics related to the digitization of the global economy, technology and innovation, macro and geopolitics, as well as scientific progress, especially in the fields of cosmology and the brain. I will frequently state things in the newsletter that contradict my own views in order to be provocative. I often I try to make jokes, and they aren’t very funny – sorry.

I may include links to third-party websites as a convenience, and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by NZS Capital, LLC (“NZS”). If you choose to visit the linked sites, you do so at your own risk, and you will be subject to such sites' terms of use and privacy policies, over which NZS Capital has no control. In no event will NZS be responsible for any information or content within the linked sites or your use of the linked sites.

Nothing in this newsletter should be construed as investment advice. The information contained herein is only as current as of the date indicated and may be superseded by subsequent market events or for other reasons. There is no guarantee that the information supplied is accurate, complete, or timely. Past performance is not a guarantee of future results.

Investing involves risk, including the possible loss of principal and fluctuation of value. Nothing contained in this newsletter is an offer to sell or solicit any investment services or securities. Initial Public Offerings (IPOs) are highly speculative investments and may be subject to lower liquidity and greater volatility. Special risks associated with IPOs include limited operating history, unseasoned trading, high turnover and non-repeatable performance.